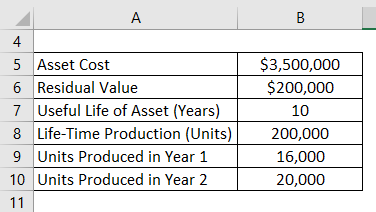

Depreciation calculation example

Example 2 Sum of Years Digit Method SOYD. Salvage is listed in cell C3 10000.

Depreciation Formula Examples With Excel Template

The straight-line depreciation rate is 20.

. This lets us find the most appropriate writer for any type of assignment. The cost is listed in cell C2 50000. The double declining balance depreciation method calculation is.

Businesses depreciate long-term assets for both tax and accounting purposes. Depreciation for each year will be 20000 in SLM of Depreciation. If it is put into service during the second half of the month the calculation of.

For tax purposes. Company A purchases a manufacturing machine for 25000 on March 1 2020. Example of the Double Declining Balance Method.

And life for this formula is the life in periods of time and is listed in cell C4 in years 5. Assuming the machine has a salvage value of 400 you can depreciate 1200 of the cost over the life of the copier. Formula of Straight-Line Depreciation Example of Straight-Line Depreciation.

Hence the calculation is based on the output capability of the asset rather than the number of years. Calculation of amount of depreciation. For example if straight line depreciation rate is 10 and the company uses a 200 of the straight line depreciation rate.

To get a better understanding an example of a half-year convention with a depreciation schedule is shown below. The company plans to use the truck for 5 years and expects to sell the truck for 1000 after 5 years. For example the first-year calculation for an asset that costs 15000 with a salvage value of 1000 and a useful life of 10 years would be 15000 minus 1000 divided by 10 years equals.

Double Declining Balance Depreciation Method. It had a salvage value of 2000. So EBITDA -116 325 -126 570 653 million.

Depreciation for Period Number of Time Units Used in a Period x Depreciation per Unit Time. An example of Depreciation If a delivery truck is purchased by a company with a cost of Rs. The double declining balance calculation does not consider the salvage value in the depreciation of each period however if the book value will fall below the salvage value the last period might be adjusted so that it ends at the salvage value.

The reason is that there is an exceptional item called Loss on extinguishment of debt which is around 30 million that comes between Operating Income Operating Income Operating Income also known as EBIT or Recurring Profit is an important. The next step in the calculation is simple but you have to subtract the salvage value. This calculation ensures that the fixed asset is fully depreciated at the depreciation ending date.

For our example scenario well assume a company spent 1. Similar to the activity depreciation the time depreciation calculation results from 2 equations. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

Accounting and tax rules require you to place the asset in service set it up and start using it in the first year you start claiming depreciation. If the salvage value is assumed to be zero then the depreciation expense each year will be higher and the tax benefits from depreciation will be fully maximized. Calculate per unit depreciation.

Suppose the cost of asset is 1000 and rate of depreciation 10 pa. The calculation of depreciation under this method will be clear from the following example. For example the annual depreciation on an equipment with a useful life of 20 years a salvage value of 2000 and a cost of 100000 is 4900 100000-200020.

The depreciation cost is evenly spread each year until the assets life. The book value of the equipment at the beginning of year 5 is 64800 whose 40 is 25920. 2 Written Down Value Method.

Calculation field is deactivated and whether the Part of Book Value field is activated on the FA Posting Type Setup page. Company A purchases a machine for 100000 with an estimated salvage value of 20000 and a useful life of 5 years. Solved Example For You.

Other than depreciation rates the basic differences depreciation calculation as per the income tax Act and companies act is the method used for depreciation calculation. Learn how to calculate it using the common straight-line and accelerated methods. The straight line calculation steps are.

Depreciation Calculation Methods Various depreciation calculation methods are mentioned below. Its the simplest method but also the slowest so its rarely used. Step 3 calculation of depreciation expense and preparation of schedule.

You dont have to stick with annual straight-line depreciation. You buy a copy machine for 1600 at the end of March. For our example copier the equation looks like this.

Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along. The calculation of the depreciation amount happens after deducting the salvage value. Anil purchased a machine on 1 Apr 2015 for 400000.

The company ABC bought a delivery truck for 45000 to use in the company. A fixed asset has an acquisition cost of LCY 100000. Salvage Value Example Calculation.

A copy machine is considered 5-year property for tax purposes. For example the depreciation will be computed as follows. Double Declining Balance Depreciation Example.

The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset. An asset for a business cost 1750000 will. Example of the Sum of the Years Digits Method.

CFI Company purchases a machine for 100000 with an estimated salvage value of 10000 and a useful life of 5 years. Declining Balance Method iii. Depreciation per unit time and depreciation for a period based on total time the asset was used in that period.

For example if a company purchased a piece of printing equipment for 100000 and the accumulated depreciation is 35000 then the net book value of the printing equipment is 65000. We need to define the cost salvage and life arguments for the SLN function. Maximum Amount Method iv.

Example - DB1SL Depreciation Using Half-Year Convention. Now you will notice some differences between the values of formula1 and 2. Annual Depreciation Purchase Price of Asset Salvage Value Useful Life.

The manufacturing machines useful life is five years. Per unit Depreciation Asset cost. The useful life of the machine is 3 years and its estimated residual value is 40000.

Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life. How to Calculate Straight Line Depreciation. NBV of computer after 1 st year Rs 40000- 4000 Rs.

Units of production depreciation is the depreciation method that uses the number of. If this depreciation is used the book value of. 100000 and the expected usage of the truck are.

Depreciation is the value of a business asset over its useful life. 1320 12 110. So in our example the depreciation amount during the first year is.

Depreciation Cost of Asset Net Residual Value Useful life 400000 400003 120000 pa. Divide the sum of step 2 by the number arrived at in step 3 to get the annual depreciation amount. In total the copiers monthly.

In our example the copier cost 8600 at first.

Depreciation Formula Examples With Excel Template

Declining Balance Method Of Depreciation Formula Depreciation Guru

Declining Balance Depreciation Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods Principlesofaccounting Com

How To Use The Excel Db Function Exceljet

How To Use The Excel Amorlinc Function Exceljet

Depreciation Of Fixed Assets Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template